- Cold Capital

- Posts

- Private company investment types

Private company investment types

Learning about the private markets

Acquiring shares in private companies is a growing trend among sophisticated investors. While the allure of gaining access to the next unicorn is undeniable, the secondary market for private stock comes with unique challenges.

The trading of stock in private companies is still relatively new and is far from as seamless as purchasing shares via a public equities brokerage account. Unlike the streamlined, high-speed trading of public equities, buying private shares requires patience, knowledge, and an understanding of the structures available to you. No two transactions are exactly the same, even if they involve shares in the same company.

Here, we unpack the primary methods of purchasing private stock, exploring their mechanisms, risks, and rewards.

Direct Purchase: The Purest Path

Imagine buying shares of Apple or Tesla, but instead of clicking on a brokerage app, you’re negotiating directly with a shareholder over email. That’s essentially how direct purchases work in the private market. You identify a willing seller—often a current or former employee or an early investor—and negotiate terms to acquire their shares in the private company. This process is the most straightforward but still takes significantly more time than buying public company shares.

However, many companies, including sought-after ones like SpaceX, do not allow trading of their stock due to the administrative burden it creates. Additionally, it’s important to determine whether you’re purchasing common or preferred stock. Common stock, typically granted to employees, lacks the extra benefits of preferred stock, which is usually held by venture capitalists and valued higher.

How It Works

Locate a shareholder with shares to sell directly or via a platform.

Agree on a price, typically influenced by recent company valuations or secondary market activity.

Complete due diligence and legal agreements, including transfer approvals from the company.

Pros

Transparency: You know exactly what you’re buying and who you’re buying it from.

Simplicity: No intermediaries; you own the shares outright.

Low to no fees: Depending on the transaction, fees may be minimal or nonexistent.

Cons

Responsibility: Ensuring the shares are valid is entirely your responsibility.

Company Restrictions: Some companies prohibit trading of their stock.

For investors who value clarity and direct ownership, this is the cleanest option. However, finding a willing seller and navigating the transfer process can be a challenge.

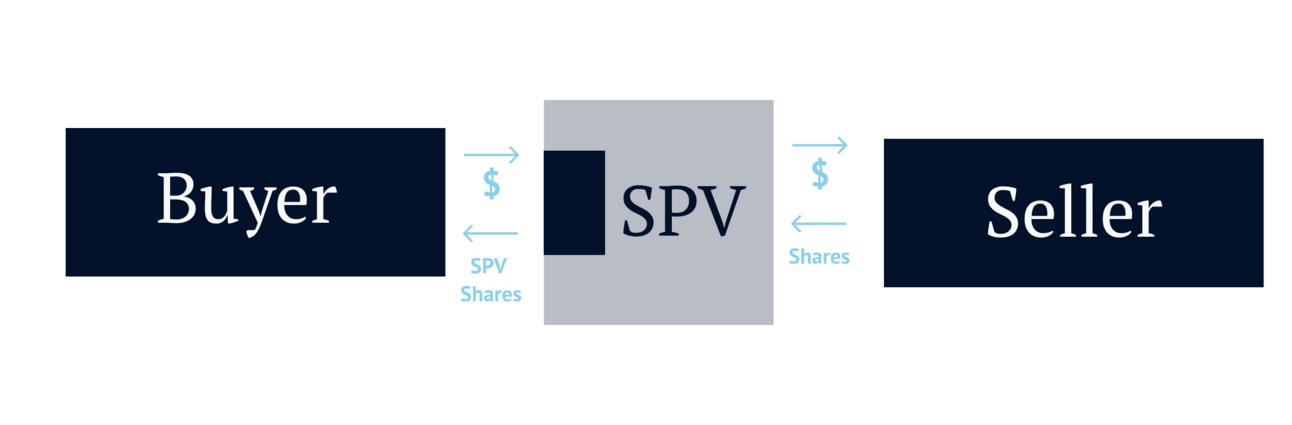

Via SPV: Strength in Numbers

When buying directly isn’t feasible, a special purpose vehicle (SPV) can help. An SPV is a legal entity created to pool funds from multiple investors to purchase shares in a private company. By investing in the SPV, you indirectly own a slice of the target company’s shares.

For example, suppose a seller is offering $1M worth of stock. While you may not want to invest the full amount yourself, an SPV can aggregate ten investors who each contribute $100K to purchase the shares. This method unlocks possibilities to buy or sell in companies with limited stock availability and can bypass trading restrictions by reducing the administrative burden on the issuing company.

How It Works

A group of investors pools capital into an SPV.

The SPV uses the funds to purchase shares from a seller in the private market.

Investors own proportional shares of the SPV, which owns the company’s stock.

Pros

Accessibility: Aggregates smaller investments to meet minimum purchase thresholds.

Professional Management: Experienced operators manage SPVs, conducting due diligence to ensure the validity of the transaction, decreasing risk.

Potential Liquidity: Some SPVs allow trading of their shares, making it easier to transact than with the underlying company’s stock.

Cons

Fees: SPVs typically charge management and administrative fees.

Indirect Ownership: You own shares in the SPV, not directly in the company.

SPVs democratize access to high-value shares but require trust in the SPV’s managers and acceptance of layered ownership.

Dual-Layer SPVs (and Beyond): A Russian Doll of Ownership

Occasionally, SPVs themselves invest through other SPVs, creating a cascade of ownership layers. For example, you might invest in SPV A, which owns a stake in SPV B, which holds shares in the target company. While this setup can unlock exclusive opportunities, it also introduces significant complexity.

Why Add Layers?

Large sellers or funds may require this structure for compliance or operational reasons.

Multi-layer SPVs can grant access to deals otherwise inaccessible to individual investors. For example, if a company prohibits trading its stock, an SPV already holding shares might allow one of its investors to sell their stake through another SPV.

Pros

Access: Enables participation in deals otherwise unavailable to individual investors.

Leverage: Multiple layers can sometimes reduce individual risk by diversifying exposure.

Cons

Complexity: More layers mean more parties involved, increasing the likelihood of disputes or delays.

Transparency Risks: Tracking ownership rights through layers can be murky.

Higher Costs: Each layer often involves additional fees and administrative expenses.

While these structures can unlock rare opportunities, the additional complexity warrants caution. The more layers involved, the harder it becomes to trace your ownership back to the target company.

Forward Contracts: Betting on the Future

Forward contracts provide another route to private equity. Instead of owning shares outright, you sign an agreement to receive shares at a future liquidity event, such as an IPO or acquisition. In return, you provide upfront funding to the seller. While this locks in a lower share price, it’s not without risk. If the share value rises significantly, the seller may attempt to renege on the agreement.

How It Works

The seller commits to transferring shares to you when certain conditions are met.

You provide funds upfront or agree to pay a predetermined price upon transfer.

Generally, these are not advisable for non-institutional investors like VCs and private equity funds

Pros

Lower Initial Costs: Often requires less capital upfront compared to direct purchases.

Flexibility: Allows access to shares without an immediate transaction.

Cons

Event Dependency: If the liquidity event doesn’t occur, you may never receive the shares.

Counterparty Risk: Relies on the seller fulfilling their obligations.

Legal Complexity: Forward contracts can be difficult to enforce and exist in a legal gray area.

Forward contracts are a high-risk, high-reward strategy suited to those willing to trade security for potential upside.

Tender Offers: A Unique Opportunity

Tender offers are occasional events where a company facilitates the sale of its private shares. Unlike other methods discussed here, tender offers are not standalone transfer types but moments in time when share transfers happen consistently and at a single, agreed-upon price.

How It Works

The company announces a tender offer, setting a price for its shares.

Current shareholders can sell their shares to participating buyers at the set price.

Buyers typically use direct purchases or SPVs to participate.

Pros

Predictability: Shares are traded at a pre-determined price, reducing negotiation complexities.

Liquidity: Often allows shareholders to sell in bulk, providing buyers with access to larger positions.

Cons

Rarity: Tender offers are infrequent and unpredictable.

Restrictions: Participation may be limited to certain investors or share classes.

Tender offers represent a unique opportunity for investors to acquire shares under relatively straightforward terms. However, given their rarity, they are best viewed as supplementary rather than primary strategies.

Pros & Cons Summary

Method | Pros | Cons |

|---|---|---|

Direct Purchase | Clear ownership, no intermediaries | Limited availability, company restrictions |

Via SPV | Access to large transactions, pooled resources | Layered ownership, fees, reliance on SPV management |

Dual-Layer SPVs | Enables access to exclusive deals | Increased complexity, ownership ambiguity, potential points of failure |

Forward Contract | Access without direct purchase, workaround for restrictive companies | Dependency on liquidity event, counterparty risk, potential non-performance |

Tender Offers | Pre-determined price, streamlined transactions | Infrequent, potential participation restrictions |

Choosing Your Correct Investment Path

When it comes to private stock transactions, it’s easy to get overwhelmed by the variety of options. The key to success, however, lies in focusing on what works best for most investors most of the time. Direct purchases and SPVs stand out as the most effective routes, offering clear advantages depending on your priorities and risk tolerance.

Direct purchases remain the gold standard for simplicity and cost efficiency. With this method, you avoid layers of intermediaries and associated fees, gaining direct ownership of shares with minimal friction. It’s an ideal choice for investors who value clarity and control. That said, the direct route requires a hands-on approach, as you’re solely responsible for conducting due diligence, ensuring compliance with company policies, and navigating the transfer process.

For those seeking a more guided approach—or who simply don’t have the time to conduct exhaustive due diligence—investing via a reputable SPV offers a compelling alternative. By pooling resources with other investors, SPVs open doors to deals that might otherwise be out of reach. Moreover, an experienced SPV manager handles the heavy lifting, from vetting the opportunity to managing legal intricacies, ensuring you can invest with confidence and peace of mind. While SPVs come with fees and indirect ownership, the benefits of professional oversight often outweigh these drawbacks for those new to private markets or targeting larger, more complex opportunities.

Other structures, such as forward contracts or dual-layer SPVs, should generally be seen as options of last resort. While these strategies can unlock rare opportunities—such as accessing shares in highly restricted companies—they introduce significant risks and complexity. Forward contracts, for example, rely heavily on counterparty performance and the occurrence of a liquidity event, while dual-layer SPVs often obscure the chain of ownership and come with higher fees. For most investors, these methods are best reserved for extreme cases or when no other options exist.

In private markets, there’s no one-size-fits-all solution, but narrowing your focus to direct purchases and SPVs will serve you well in the majority of scenarios. Direct transactions minimize costs and maximize clarity, while SPVs provide access to expertise and broader opportunities. The more complex paths—forward contracts, multi-layer SPVs, and tender offers—may offer occasional value but often demand a level of risk tolerance and expertise that’s beyond the needs of most investors.

At Cold Capital, we’re here to ensure you make the right choice for every opportunity. Whether you’re navigating the simplicity of a direct transaction or exploring the added layers of an SPV, our insights help you act with confidence. Investing in private companies can be complex, but with the right approach—and the right partner—you can turn potential roadblocks into rewarding opportunities.